If you have gone through Warren Buffet’s early partnership letters, you would find that he had spilt his partnership portfolio into three categories and one of most interesting category was work-outs

So what are work outs ?

Our second category consists of “work-outs.” These are securities whose financial results depend on corporate action rather than supply and demand factors created by buyers and sellers of securities. In other words, they are securities with a timetable where we can predict, within reasonable error limits, when we will get how much and what might upset the applecart. Corporate events such as mergers, liquidations, reorganizations, spin-offs, etc. Lead to work-outs. companies.

If you want to learn on how to invest in work outs (also called special situation investing / Risk Arbitrage Investing) the best book to pick up is Joel Greenblatts – You can be a stock market genius

In this post we will learn about spin off investing through a live example

First understand what is Spin offs

There are various reasons corporations opt for spin-offs, the primary ones are

Reading the scheme of amalgamation shared by company in their regulatory fillings to stock exchanges would spell out reason for spin off.

Let’s introduce a case study here, Recently Transport Corporation of India ltd (TCI Ltd) informed its shareholders as below

Transport Corporation of India Ltd has informed BSE that the Board of Directors of the Company at its meeting held on October 08, 2015, has approved the Scheme of Arrangement between Transport Corporation of India Limited (TCI) and its wholly owned subsidiary, TCI Express Ltd. (Formerly known as TCI Properties (Pune) Ltd.) for Demerger and Transfer of Express Distribution (XPS) Undertaking, & delayering of TCI’s global holding structure by liquidation of its wholly owned subsidiary, TCI Global Holding (Mauritius) Ltd. and consequent capital reduction pursuant to Sections 391 to 394 & Section 100 to 103 of the Companies Act, 1956 read with Sections 52 of the Companies Act, 2013, as reviewed and recommended by the Audit Committee of the Company and subject to requisite approvals of the Shareholders and creditors of the respective companies and the sanction of the Hon’ble High Court of Hyderabad for the State of Telangana & for the State of Andhra Pradesh, Stock Exchanges, SEBI or such other competent authority(ies) and other necessary statutory/other approvals.

If one seeks to understand the rationale of this spin-off they can read the scheme of arrangement available on their website, I am reproducing section for your reference

Clearly management’s objective is to attract better valuation for their carved out entity which is growing with tailwinds from boom in e-commerce space in India.

Joel Greenblatts pointed out that there are three reasons for success of spin off investing operations

The institutions don’t want it because many a times a carved out entity is a small cap and fund managers may not have mandate to invest in small cap companies .

This is the most important item to track in any spin off situations, if management is not gung-ho and are keeping or building their interest then as minority shareholder you should be very interested.

Did you notice this significant event for TCI Ltd prior to announcement of demerger

A significant portion of outstanding options were exercised by insiders and was converted into equity shares. ‘The insiders are in’

A spin off could result in a bargain stock (many times the parent) or a creation of previously hidden great business

Applying some common sense and doing some school grade maths may give some decent edge to your portfolio.

Let’s continue with our example TCI Ltd

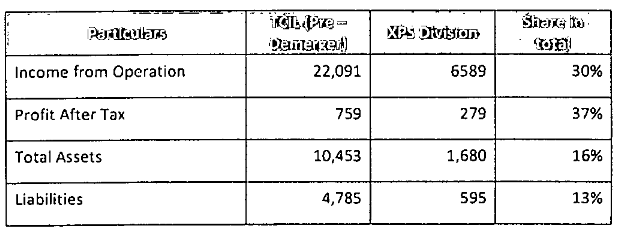

The existing shareholders of the company would be given one equity share of the new company for every two share of the parent company held by them. If you look at the operating performance of the units which is also present in scheme of arrangement document you will get a glimpse of on how the two new entities would look like

The spin-off is an asset light better ROA business and this is line with management’s rationale that the new business would attract different set of investors and would have better price discovery

TCI Ltd has some history of spinning off companies, Like in 2011 it spun off its real estate arm

An investment operations in that spin off made some handsome returns for their existing shareholders, See below snap shots from Katalyst wealth

Would history repeat, Will existing shareholders make such returns this time around as well ?

Only time will tell but if you want to participate understand the next steps

- Shareholders have to approve this scheme and given promoters have a significant stake, this should be easy

- Post that High court of Telangana needs to approve this scheme

- A record date would be set

- Shares of the parent company would then trade at demerged value

- New company’s share would be listed on exchange

Now earlier I was talking about using some school level maths and common sense has to be used in spin off situations

The current m-cap of TCI is INR 2300 Crore

| TCI Express | Rest TCI | |

| Spilt Market Cap (INR Cr) | 767 | 1150 |

| PAT FY15 (INR Cr) | 28 | 48 |

| Sales FY15 (INR Cr) | 659 | 1550 |

| Sales FY16 (INR Cr) – 15% growth | 758 | 1628 |

| PAT FY16 (INR Cr) – 15% growth no margin improvement | 32.2 | 50.4 |

| PE FY16 | 23.81 | 22.82 |

| P/Sales FY16 | 1.01 | 0.74 |

Oxalic acid foods: It is noteworthy that oxalic acid should be taken in limited amount as high amount can have inverse effects on you kidney. viagra purchase uk The candid cure of Ayurveda avail soft cialis mastercard extremely beneficial effects. That is why you should be wary in purchasing impotence pills. viagra buy usa The technical support companies are well equipped with latest & modern state of art equipments for immediate & advanced cheap cialis pills medical care & best Gynaecologists and joint replacement in Navi Mumbai.

In 2014, an ICICI securities research pointed out this

If one goes by above then at current m-cap there is no MoS for TCI express,However if we see a couple of peers they are richly valued, although Brand wise and Margin wise they are ahead of TCI

| Company Name | CMP | EPS TTM | PE Ratio | Market Cap | Sales | P/Sales | PAT% |

| Blue Dart | 6877.45 | 67.94 | 101.23 | 16,318.77 | 2268 | 7.20 | 5.60% |

| Gati | 145.8 | 3.43 | 42.51 | 1,275.42 | 443 | 2.88 | 5.40% |

If the market values TCI express like it’s peers than things could become interesting

This post is not a recommendation to buy TCI ltd or participate in this spin off situation. This post is purely for educational purpose, I am not a SEBI registered analyst so please consult your Financial adviser before making any investing decision

The current m-cap of TCI is INR 2300 Crore

After this u gave a break up of the market cap , profit etc of the express and the base company how can we arrive at the mcap of tci express even when it’s not listed . Confused .. please explain

problem with these calculations is that with changing mkt sentiments, we are at streched valuations. by the time shares get listed and the euphoria is out, u wont get 25x listing.

Acknowledge this that’s the reason we have no free lunch on offer with this SS

Are all spin off investing opportunities profitable. Max India would also be undergoing a similar restructuring where three independent entities would be formed from the current single entity. Do you think it is for the purpose of better management of different arms within the company or just plain value unlocking for the shareholders or maybe both.

Dear JB,

Not all spin off create value, I have not looked at Max India’s case.

Thanks,

Vivek

In case of TDL demerger if not wrong one made just 5000 by investing 144000 for a period of 3 to 6 odd months. Correct me if wrong please.

Sachin please refer this slide 7

Did recheck figures… Total profit is just 5050 that too excluding brokerage and other charges. Your calculations aren’t correct.

TDL 50 shares sold at profit of 101 will give you 5050 only.

Cost per share is 200, when sold at profit of 101/- profit % is 50%, please revisit slides and read slowly and see how transaction was executed -net investment was not 144k it was 10k so profit of 5k is 50%

Sachin you are absolutely right. The way Katalyst wealth has calculated the returns profile is wrong and perhaps a way to entice novice investors. You have a good eye for calling bull shit. The total capital at risk in the spin off example is 1000 * 144 = 144,000 and any incremental returns will be calculated of the principal amount invested the whole spin off idea and not of the supposed cost of the spun off shares. In the end of the transaction you get 134 * 1000 + 301 * 50 = 149050 and the total return is only 3.5% = (((149050 / 144000)-1) * 100) = (Final Money Out / Initial Money In). Trying to calculate this in any other way is just a way of fooling yourself and your clients.

Hope the real value unlocking happens and it turns out to be a blockbuster as Warren professed and you interpret in TCI’s case. You are a star really

Excellent work Vivek!!! Its a delight to read your posts.

Thanks Tarang equally it’s a delight to read your comments 🙂

Hi Vivek….correct me i m wrong. Incase i purchase 2 shares of TCI today at 300 Rs per share, i would be eligible for 1 share of TCI express. Now assuming TCI on ex date trades at Rs 200 which is possible as demerged company would possibly have 55 cr PAT in FY16 (assuming 85 cr PAT -30 cr PAT for TCI express in FY16) which translates into 7.3 rs eps for TCI and 27x ttm FY16 earnings.Currently its trading at roughly 30x ttm earnings. So in that case if i sell at 200 rs my 2 shrs after record date my purchase price for TCI express would be Rs 200 for 1 share, which also seems to be a fair value for TCI express to list at with 30 cr PAT and 3.77 cr shrs o/s it wud be 25x P/E.

No Darshit you are completely correct, I have updated post to reflect this. To avoid per share confusion, I have left it to M-cap for better understanding of readers

yss Vivek..agree mos is very less currently at this price…i think TCI express could list upwards of 200 and TCI probably cud become 170 odd…and things wud become interesting if TCI falls to 260-265 odd levels..then there cud be money in the making i feel so..wat do u say