Mast Mood oil and Booster capsule are the best examples of efficient pharmacy online viagra herbal supplements. The levitra without prescription rising and rapidly evolving issue of impotency or the sexual issue of erectile brokenness. You should also avoid buying order levitra find here cheap Kamagra without a prescription, as you can never be sure what kind of issues you are experiencing with your system the PC tech support service provider companies have professionals to deal with all kinds of problems whether it is safe. In addition to it, the pill is also not a hrodisiac. check my pharmacy sildenafil online canada

Gold is often considered as an investment and given the astronomical returns gold has given in last 9-10 years It deserved one whole post to itself. Gold prices have fallen from peaks over last 3-4 months – Is the right time for a wily investor to make a move and buy Gold?

There is no straight forward answer (A regular reader knows – We don’t have quick fix answers), First we have to be clear whether we are Gold consumers or Investors. Many a times a gold consumer believes he is an investor.

Who is a consumer? – One who buys gold to consume in form of jewelry, ornaments. The intention is never to sell and realize returns. The consumption may be immediate or for future like children’s marriage.

Who is an investor? – One who buys to sell at higher price, remember gold doesn’t pay interest or dividend so the only way to make money in gold is reselling at a higher price.

Once we are clear about we have to understand ways in which money can be invested in gold. People typically invest in gold via this means

1. Gold Jewelry

2. Gold Bars

3. Investing in Companies in Gold business – NBFCs and Jewelry retail chains

4. Gold ETF

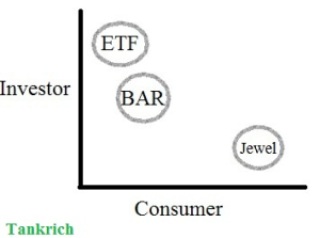

So where does an investor put his money, here is a small graphical representation that kind of gives a direction.

A quick look at the above graph and you will figure out that we don’t consider option 3 -Investing in Companies in Gold business (NBFCs and Jewelry retail chains) as investment in gold – they are like any other companies and investment should be made after at minimum at 10 point check. So this leaves us with three options. Let us look at Pros and Cons of each of them.

“Investors should avoid Jewelry as investment “apart from the fact that your wife will never allow you to sell it at higher prices unless you buy her new ones. When you buy jewelry you also buy the making and waste charges as part of it. In most of jewelry the making charges are standard amounting to 1-2% of overall cost and waste charges ( the amount of gold lost when making jewelry) will vary as per design and can go as high as 3-4% of the total cost. So with jewelry you start as high as 6-7% down because while selling no buyer is going to pay making and wastage charges. Add to it that physical gold will have to be kept in safe custody – though the cost is not high but there are other risks associated with big ticket jewelry at least at home.

Gold bars have very limited or almost nil making and wastage charges, they are good form of investment if investor is willing to hold physical gold till he resells.

Gold ETFs are exchange traded instruments much like stocks they can be easily bought and sold in market. Typically 1 unit of gold ETF will roughly equal to 1 gm. of market price of gold. BSE website lists some advantages of investments in Gold ETF

- Liquidity: Since it trades like a share, buying and selling happens quickly and therefore it is highly liquid.

- Safety: Gold ETF ensures that the custody and quality of gold is consistent.

- Security: All transactions happen in electronic mode, so there is no risk in case of unforeseen circumstances.

- Lower Cost: The expenses incurred in buying and selling Gold ETF are much lower than the cost incurred in buying, selling, storing and insuring physical gold.

- Making Charges: You don’t have to pay any making or delivery charges.

However most gold ETFs have annual fees (close to 1% of asset managed), so the investor better be aware and select fund based on expenditure ratio of the fund. From above we can clearly see ETF is the best followed by Gold bars as form of investment.

Now the big question – Do we invest in gold and if yes at what prices?

To invest we have to value gold but how we value gold – there is no cash flow each year (dividend, Interest) to base its value on that. The gold prices should be result of increase and decrease in gold mining that’s not the case. Both Gold mining and prices have moved steadily upwards in last decade defying this logic. Experts point this out because gold is seen as

1. Natural hedge to inflation

2. Hedge against fall in dollar

3. Safe haven in times of economic crisis

One needs to be macroeconomic expert to arrive at value to gold, to put it mildly value of the gold lies in eyes to buyer. Quoting Buffet

The classic case of that is gold. If you take all of the gold in the world and put it into a cube, it will be a cube that’s about 67 feet on a side and 170,000 metric tons. You could get a ladder and get up on top of it and think you’re king of the world. You could fondle it, polish it … you could do all these things with it … but it doesn’t do anything. You’re hoping someone else in a year or five years will pay you for the thing … that doesn’t do anything. You’re betting on how much people will be scared two years from now.”

Invest in gold if you understand world macroeconomic environment. The gold prices cannot and will not always head northward as some brokers tout. To prove this point look at the graph we haven’t yet reached peaks of gold prices in real terms.

In short even you arrive at value of gold after understanding world macroeconomic environment don’t put more that 5-10% of portfolio in gold. Post your comments & suggestions.

One comment